Exur Insurance Technologies

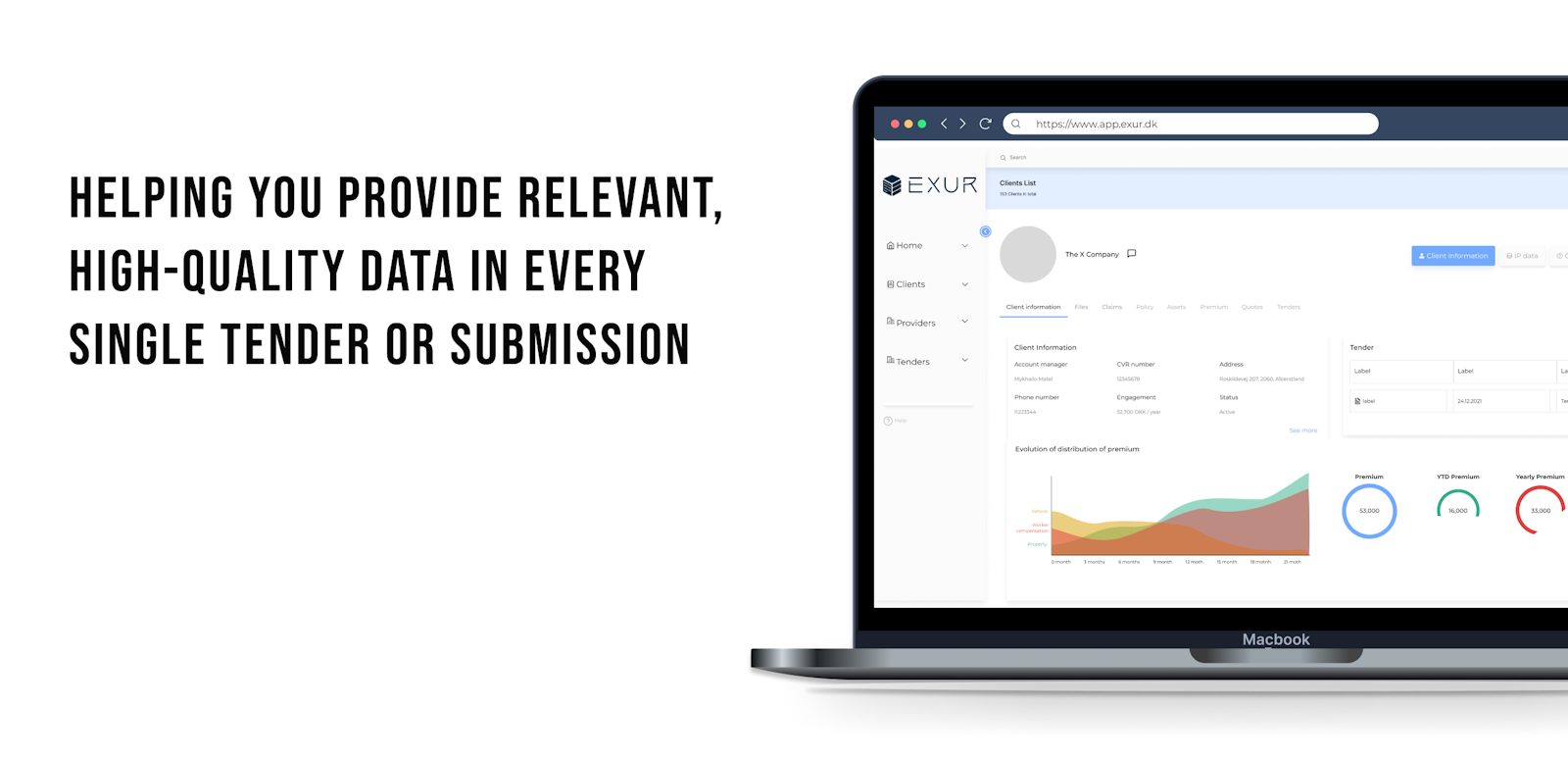

Exur is a Danish startup developing tech for the insurance industry. Our core product is a data enrichment- and delivery platform helping insurance intermediaries with the extensive data collection and processing that precedes an insurance tender or submission.

Our mission is simple: we want to activate and engage data in any small-sized, mid-sized and large-scale insurance intermediary. We believe data is poorly leveraged in the insurance industry and it puts both buyers and sellers of insurance at a disadvantage. Therefore, our objective is to provide a method that allows insurance data to be utilized to its full potential. We do this through an innovative technology that systematizes and automates the data collection processes of insurance intermediaries.

With more than 10 years of experience from working with data and risk modelling in both the insurance and banking industry, we have developed a framework for efficiently obtaining and processing risk data. With our technology, insurance intermediaries can deliver high-quality datasets to their providing partners without wasting valuable time on manual data collection.

| Location | Denmark |

| Website | exur.dk |

| Founded | 2021 |

| Employees | 1-10 |

| Industries | Fintech, IT & Software, SaaS |

| Business model | B2B |

| Funding state | Pre-seed |

Working at

Exur Insurance Technologies

This job comes with several perks and benefits

Flexible working hours

Skill development

Social gatherings

Remote work allowed

Equity package

Near public transit

“Our objective is to provide a method that ensures insurance data is utilized to its full potential”

Emil Kwiatek,

CEO

Team

Founder, CTO

Emil Wiingaard

Founder, CEO

Emil Kwiatek

Founder, Chief Underwriting Officer