Ariia

Money laundering is a growing societal problem that annually costs Danish society between 34-59 billion or 1.7-2.9% of GDP. Besides the cost side of that, it creates a great inequality and leads to corruption which undermines society as a whole. Today the money laundering problem is rapidly increasing as the number of wanted individuals have been rising exponentially.

ARIIA is a fintech company that develops an innovative IT solution to fight money laundering and financial crime. This solution enables banks and AML (Anti Money Laundering) regulated companies to ensure that they are not facilitating or involved directly or indirectly in such affairs. The three founders behind ARIIA are specialists within the AML sector and financial services. They have a proven track record of successful start-ups in financial services.

ARIIA’s solution brings value via:

1. Compliance

Ensuring that our customers comply with all the requirements set by the authorities in money laundering legislation.

2. Savings

Providing additional savings by removing unnecessary expenses to run vendor systems on client’s premises using legacy rules engines.

With ARIIA there is no maintenance, no fine-tuning, no solutions experts required. Our tool is cloud-based, ensuring all data protection best practices (encryption, data catalogue, etc.)

3. Business growth

- up to 60% reduction in KYC cycle time

- up to 70% cut in Case Resolution time

- up to 50% reduction in False Positive hits

Such efficiency boosts will improve customer experience and will free up resources for further business development.

4. Safeguard and peace of mind.

Protecting from fines and reputational risks in an absolutely new level.

With our cutting edge technologies we are able to uncover complex business structures that mask criminals or compromised individuals' participation, obscure connections, facilitation schemes and much more.

Our cutting edge technologies:

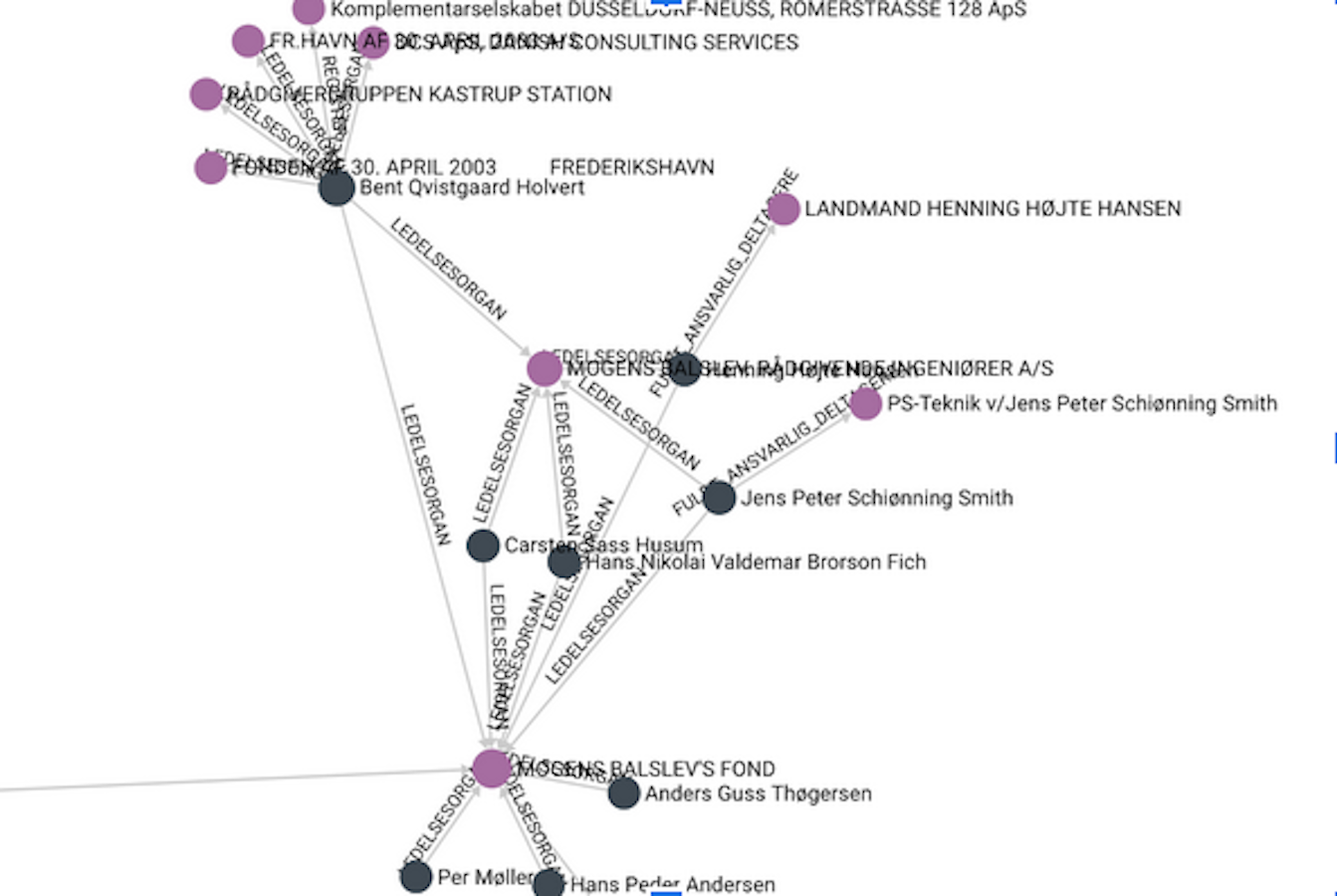

Central Knowledge Graph.

The traditional method of screening is to make “lookups” vs sanction and watch lists.

However the world is about connections and relationships. Our Central Knowledge Graph is a whole connection´s universe where we analyze companies and owners using interactive visual network.

Interconnected Single Data Lake.

Traditional approach is to work with siloed datasets that are updated one by one (often manually). We process many databases (bank data, public data, sanction lists, etc.) in a data model, which makes it possible to find far more contexts and connections vs traditional approach.

And web crawlers that run 24/7 pulling the most recent up-to-date information from vetted sources.

Intelligent Screening AI/ML

Traditional approach includes rules engines and a lot of manual work that generates inconsistencies for the overall process and other limitations.

We move from Rules Engines to ML models that learn from patterns, improve with feedback loops thus improving accuracy rates as well as ensure consistency in the process that is crucial for passing the audit from regulators.

In a nutshell: ARIIA is the innovative, adding-value solution for KYC screening, transaction monitoring, AML compliance and risks identification in a single, intuitive platform. ARIIA are currently looking for funding opportunities to develop the MLP to the next level.

| Location | Denmark |

| Website | ariia.uk |

| Founded | 2014 |

| Employees | 1-10 |

| Industries | Fintech |

| Business model | B2B, B2G |

| Funding state | Bootstrapping |

Working at

Ariia

This job comes with several perks and benefits